5 Tips for Education Companies to Navigate 2023 Spending Trends

It can be difficult for education companies to navigate the turbulent sector that is United States K-12 education today. Divisive education politics, constant state and federal funding updates, and the ongoing ripple effects of the Covid-19 pandemic have created both challenges and opportunities that education companies must maintain a pulse on if they are to succeed in this market. Read on for a status update on federal and state-level funding and spending, forecasted K-12 spending trends, and our expert recommendations to help you continue providing your products and services to schools in today’s economic and political climate.

Federal and State Level Education Funding Updates

To forecast trends in spending, we first need to unpack the current state of funding. Overall, the U.S. Department of Education received a $3.2 billion increase in funding to a total of $79.6 billion for fiscal year 2023, following a similar increase the year prior. While the total still falls short of the $88.3 billion originally requested by the current administration, the increase was a welcome boost by the Education Department.

Funding continues to vary widely at the state level. Public education spending statistics indicate that K-12 education funding and spending vary significantly across states. For example, while New York spends the most per student in public education, with an average spending of $23,091 per student, Utah spends the least per student, with an average spending of $7,472 per student. In terms of total public education spending, California spends the most, with a total spending of $101.6 billion, followed by Texas, which spends $60.6 billion.

Tip #1: As you market, consider per pupil spending by state. Where are there opportunities and where might you need to be flexible with certain districts with slimmer budgets? Be prepared to offer solutions that are aligned with individual budget constraints and priorities.

Status Report on Spending So Far

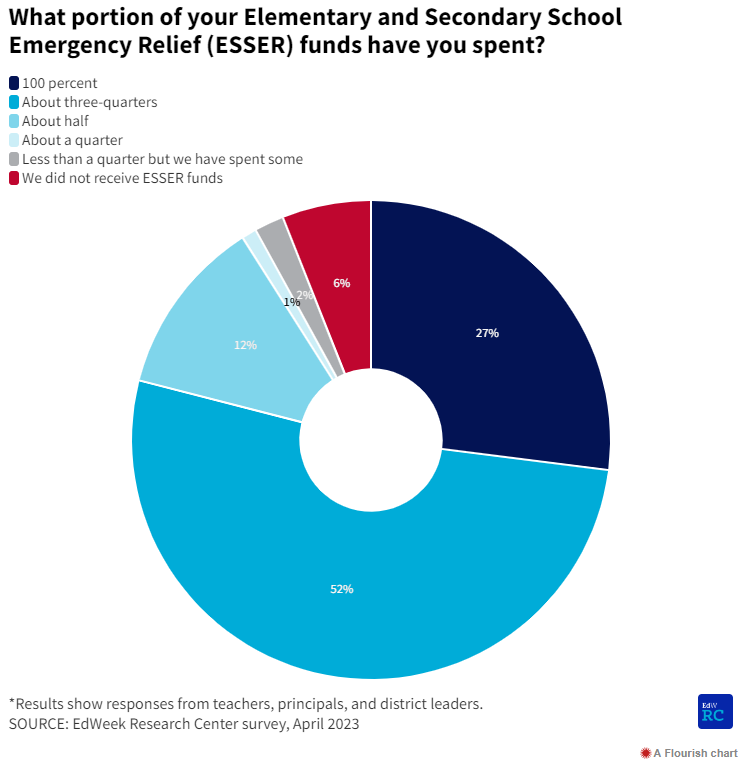

To address urgent needs, school districts across the US have heavily relied on federal Elementary and Secondary School Emergency Relief (ESSER) funds, but these funds are running out. According to a recent EdWeek report, most district leaders say they're almost done spending ESSER funds. The report found that 72% of district leaders say they've already spent more than half of their ESSER funds, and 9% say they've spent all of it. So far, ESSER funds have been used for a wide variety of initiatives, from purchasing personal protective equipment early in the pandemic, to upgrading technology and tech infrastructure, to hiring additional staff to address learning loss caused by the pandemic.

Source: EdWeek.org

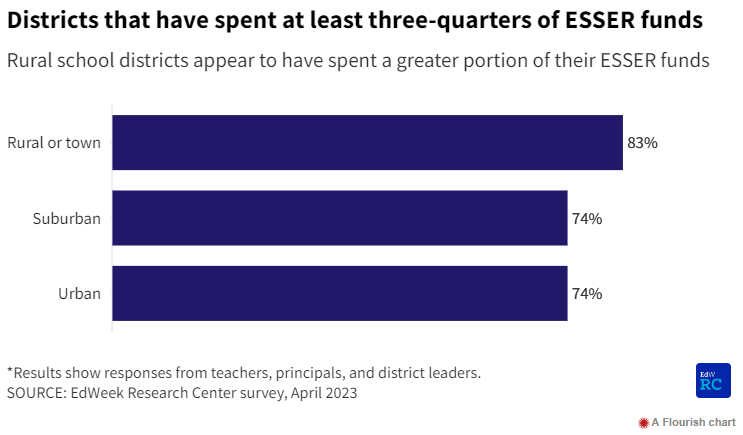

Another spending trend emerged along district type lines. Currently, urban and suburban districts generally have a larger chunk of ESSER funds remaining than their rural counterparts.

Source: EdWeek.org

However, all school districts are facing the looming ESSER funding fiscal cliff come September 2024. Some districts will fare better than others, but according to economics experts, districts will have to cut costs by about $1,200 per student on average in the 2024-2025 school year. Fifteen states will likely take the biggest hit as ESSER funds expire. Among the most vulnerable districts are:

Those using ESSER funds for ongoing financial obligations, like new hires and raises

Urban districts, districts with delayed in-person instruction, and Northern states due to declines in student enrollment

Districts more dependent on state funding or more impacted by economic slowdowns

Trend Forecasting in Education Spending

In looking at governors’ education spending proposals and priorities, six key themes emerge for likely K-12 spending.

At least 35 governors increased investments in education overall and made adjustments to state-level funding practices.

At least 34 governors placed a premium on career and technical education (CTE) and workforce development, with a focus on increasing apprenticeships and improving workforce readiness specific to each state’s needs.

At least 29 states are focused on teacher recruitment, staffing, and retention and many have promised increased wages for teachers.

Early childhood and preschool education is a focus for at least 28 states.

At least 22 governors are focused on specific instructional initiatives and supports that emphasize reading, literacy, high-quality curriculum, and student achievement.

At least 21 states plan to increase funding to support students’ and staff physical and mental health, as well as social and emotional wellness.

Tip #2: Based on these six needs and trends, identify where your offerings align and supplement. Prioritize those products and services in your upcoming marketing strategy.

Tip #3: It’s important to remember that each state (and district, for that matter) is unique, so education companies should certainly take a close look at education spending proposals at the more granular state level to identify specific market opportunities aligned to their strengths and offerings.

Tip #4: As states and districts prepare their 2023-2024 budgets and evaluate which initiatives positively impact student achievement and continued learning recovery, they can and will change course in their spending plans. To remain a spending priority, education companies must provide compelling proof points and success stories to keep clients confident in their services.

Future-Proof with Strategic Marketing

Tip #5: Whatever the trends, an essential next step for any education company is to future-proof your business and offerings against the looming fiscal cliff. Have honest conversations with current clients and prospects about the feasible longevity of contracts and partnerships. Be ready to provide case studies, success stories, and other data points to remind clients of why your partnership should remain a priority.

Looking for a cost-effective way to amp up your marketing strategy? Our new, on-demand Ed2Market Academy will get you and your team equipped to succeed in today’s and tomorrow’s education climate.

Author Name: Katie Stoddard

Katie Stoddard is the President and Founder of Ed2Market. With a background in teaching and 15+ years in education marketing, she helps brands connect with schools and educators.